1.American Express Centurion Card

The American Express Centurion Card is often described as one of the most prestigious and exclusive cards available globally. Crafted from anodised titanium, it is recognised not only for its distinctive appearance but also for the level of status associated with it.

Exclusivity & Eligibility

Access to the card is strictly by invitation. There is no advertised spending limit, as it operates without a pre-set cap. Invitations are typically extended to individuals who demonstrate exceptionally high annual spending on other American Express cards — commonly ranging from approximately $250,000 to over $1 million per year — along with a strong overall financial profile.

Privileges & Services

A fully dedicated concierge team is made available around the clock, providing personalised assistance for travel, dining, events, and other lifestyle arrangements. Complimentary elite status is granted with selected airlines and hotel programmes, enhancing the overall travel experience. Priority airport services, including expedited arrival and departure support, are also arranged to ensure a seamless journey.

Financial Considerations

A significant joining cost is required, and the rewards structure is relatively straightforward, offering one point per dollar spent. As the card functions as a charge card rather than a credit card, the full outstanding balance must be settled each month.

Fees

In the United States, an initiation fee of $10,000 is charged, alongside an annual fee of $5,000. In India, the costs are considerably higher, with an initiation fee of ₹7,00,000 and an annual fee of ₹2,75,000.

2.Dubai First Royale Mastercard

The Dubai First Royale Mastercard is widely regarded as one of the most exclusive financial instruments in the Middle East. It is designed for royalty, senior dignitaries, and ultra-high-net-worth individuals, particularly within the Gulf region.

Exclusivity & Design

The card is issued strictly by invitation. Circulation is believed to be extremely limited, with estimates suggesting fewer than 200 to 300 cardholders globally.

Its physical design reflects its elite positioning. A genuine diamond is embedded within a central crest, and the edges are finished with gold detailing, making it immediately distinguishable from conventional premium cards.

Privileges & Lifestyle Services

No predefined credit limit is publicly stated, and significant purchasing flexibility is provided. High-value acquisitions — including luxury yachts or private aircraft — can reportedly be facilitated without traditional transactional constraints.

A bespoke “Royale Lifestyle Management” service is also extended to cardholders. This includes highly personalised arrangements such as exclusive travel coordination, halal fine-dining recommendations, and assistance with prayer facility arrangements during international travel — reflecting the cultural expectations of its core clientele.

Considerations

The card is not publicly available and cannot be applied for through standard banking channels. Its emphasis lies in discretion, service excellence, and status rather than traditional reward structures such as cashback or points-based systems.

Fees

An initiation fee of approximately 7,000 AED (around $1,900) has been reported. However, overall charges and financial arrangements are typically tailored and negotiated individually, depending on the client’s banking relationship.

3.J.P. Morgan Reserve Card

(Often referred to as the Palladium Card)

Discreet, powerful, and deliberately understated — the J.P. Morgan Reserve Card is regarded as a symbol of “quiet luxury.” It is reserved exclusively for clients who maintain at least $10 million in assets with J.P. Morgan Private Bank, placing it firmly within the world of elite private banking rather than mainstream premium credit cards.

Crafted for Distinction

The card is manufactured from a solid brass alloy and plated in palladium and 23-karat gold. Its weight alone sets it apart. Each card is laser-engraved with the cardholder’s signature, reinforcing its bespoke and highly personalised nature.

Elevated Travel Privileges

Generous rewards are offered, particularly for frequent travellers. Cardholders receive 10x points on hotels and car rentals booked through Chase Travel, and 5x points on flights. A $300 annual travel credit is provided, alongside complimentary United Club membership for airport lounge access and 24/7 Visa Infinite Concierge support for tailored travel and lifestyle arrangements.

Considerations

Access is not obtained through a traditional application. A substantial private banking relationship — typically involving a minimum of $10 million in managed assets — is required. While the annual fee is lower than some ultra-exclusive competitors, the true barrier lies in the significant asset threshold.

Annual Fee

An annual fee of $795 applies (as of 2026). No initiation fee has been publicly disclosed.

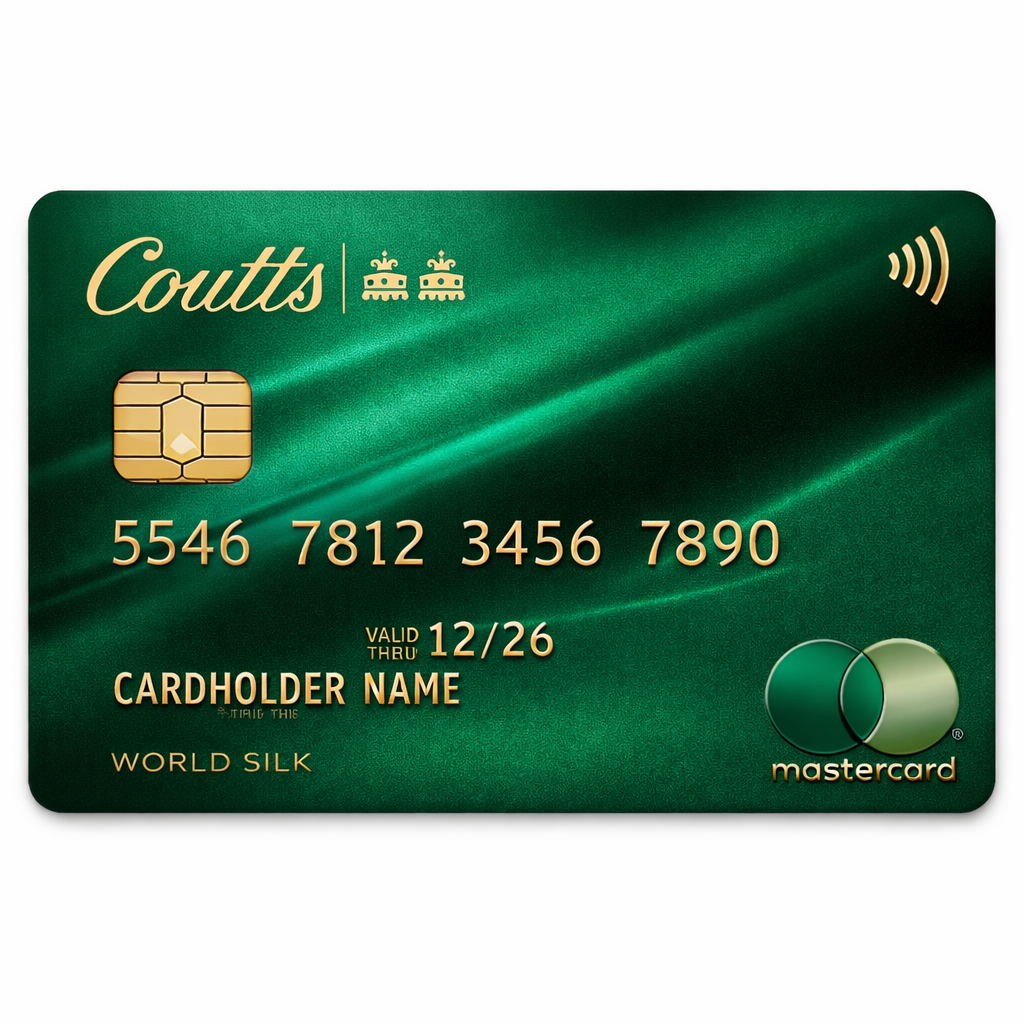

4.Coutts World Silk Card

Often associated with heritage, discretion, and British prestige, the Coutts World Silk Card is regarded as one of the most refined ultra-premium charge cards in the United Kingdom. It is issued exclusively to clients of Coutts — the historic private bank long linked with the British establishment and senior members of the Royal Household.

A Card Rooted in British Legacy

Access to the card is not obtained through a standard application. Eligibility requires an established banking relationship with Coutts, typically involving around £1 million or more in investable assets.

Unlike highly publicised “black cards,” this card embodies understated prestige. It is designed for individuals who value discretion over display — entrepreneurs, established business figures, and legacy wealth families within the UK and internationally.

Exclusive Privileges & Lifestyle Benefits

A dedicated Coutts Concierge service is provided, offering bespoke arrangements for luxury travel, priority event access, private shopping experiences, and tailored lifestyle requests.

Priority Pass membership is included, granting access to airport lounges worldwide, alongside 24/7 dedicated client support — ensuring assistance is available wherever business or leisure may lead.

The focus is not on aggressive reward points or promotional perks. Instead, the emphasis is placed on personal service, trusted banking relationships, and seamless financial management.

Considerations

The card is generally restricted to UK-based high-net-worth individuals or those with a specific and established Coutts banking relationship. For most, the true qualification is not the annual fee — but the level of wealth and trust required to bank with Coutts.

Annual Fee

An annual fee of approximately £350 is charged, which is modest compared to many global ultra-premium cards. However, the effective “cost” lies in maintaining a multimillion-pound private banking relationship.

5.Insignia Jewellery Card

The Insignia Jewellery Card is often described as one of the most extravagant and visually striking luxury cards in the world. Unlike traditional black or metal cards, this is not just a payment tool — it is crafted as a piece of fine jewellery.

Issued by Insignia Group, the card is designed for ultra-high-net-worth individuals who view exclusivity as an art form rather than a financial feature.

A Handcrafted Masterpiece

Each card is individually designed and handcrafted from solid gold. It may be set with precious stones such as diamonds, rubies, sapphires, or emeralds.

No two cards are identical. Every design is tailored to the client’s personal taste, making it closer to a bespoke jewellery commission than a conventional credit card.

For many holders, the physical card itself becomes a statement piece — a symbol of status and personal identity.

Ultra-Personalised Lifestyle Management

The primary focus of the Insignia Jewellery Card is not reward points or cashback. Instead, it centres on elite lifestyle management.

Cardholders are provided with highly bespoke services, often exceeding the personalisation offered by other ultra-premium cards. This may include:

Direct access to global luxury brand portfolios

Private event buyouts and exclusive venue access

Tailored travel experiences

Personal shopping and brand relationship management

Dedicated lifestyle advisors handling complex requests

The experience is curated around the individual rather than structured reward programmes.

Considerations

The Insignia Jewellery Card is an extreme luxury symbol. The physical card alone can cost as much as a high-end luxury vehicle.

While it functions as a financial instrument, it is primarily regarded as a prestige object — blending wealth, craftsmanship, and exclusivity into a single statement piece.

Pricing

The cost varies depending on materials and gemstones selected. Custom craftsmanship often places the price in the tens of thousands of dollars — and in some cases significantly higher.

The final investment depends entirely on the level of personalisation requested.

Why It Stands Apart

One of the most luxurious custom credit cards in the world

Crafted from solid gold with precious stones

Fully bespoke design for each client

Focused on elite lifestyle access rather than points or rewards